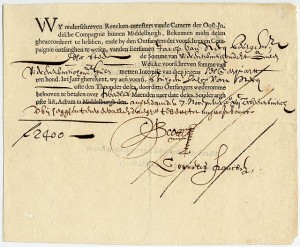

Since the Dutch East India Company (VOC) first issued a bond in the early 17th century, the bond market has evolved to include several, differing types of bonds, each with their own unique characteristics. Some of the more common and notable bonds are listed and briefly described below:

- Fixed Rate Bonds: an enormously common bond, the fixed rate bond offers a payment schedule which consists of a coupon payment of fixed value semi- or bi-annually. As the bond draws closer to maturity, the value of the coupon and principal payments decrease in real terms due to inflationary depreciation although the actual amounts remain constant.

- Floating Rate Notes: in a floating rate bond, the coupon payment is not fixed and is instead continually recalculated according to an inflation index. In this type of bond, the interest earned on investment is intimately linked to the value of the initial investment considered in real terms.

- Discount Bonds: also known as Zero-Coupon Bonds, this bond offers no coupon payments. A return on investment is still achieved, however, through the issuing of the bond at a discounted rate: that is, the bond is sold at an amount that is less than the principal payment that will be paid out when the bond reaches maturity. In this way, the interest payments are built into the maturation principal payment, and not into a fixed or floating coupon.

- Inflation Linked Bonds: somewhat similar to the floating rate notes described above, inflation linked bonds have their principal and coupon payments indexed to inflation levels. The interest earned on this bond is less than fixed rate bonds in nominal terms, but as inflation adjusted interest is earned on an inflation adjusted principal amount, the coupon payments combined with the principal payment at maturity mean that in real terms, the inflation linked bond is competitive.

- Asset Backed Securities: are bonds which guarantee interest and principal repayment based on a cash flow obtained from a possibly diverse range of assets: in this case, market information like property valuation will help in determining risk.

- Subordinated Bonds: are usually issued by banks and other financial services institutions, and are higher risk investments than senior bonds. The main difference between the two bond types, simply put, is that if the bond issuer declares bankruptcy, the senior bonds will be of a higher priority to be remunerated when the company is liquidated than the subordinate bonds.

- Perpetual Bonds: also referred to as perpetuities, perpetual bonds are without a maturity date. In this case, coupons are paid at set intervals as long as the issuer (company or governmental agency) remains able to do so. Over a long enough period of time, however, as the nominal amount of the principal investment (and hence of the coupons) remains constant, the real value of the coupon payment will diminish to a point at which it becomes negligible.

- Bearer Bond: the bearer bond is issued with a registration number to avoid duplication, but does not include the name of the owner of the bond and can therefore be redeemed by anyone in possession of the bond certificate. This allows the bond to be easily traded, but the risk involved is that the certificate can be stolen or lost.

- Registered Bond: in contradistinction to the bearer bond, the holder of a registered bond is recorded by the issuer, and coupon and other payments will only be made to the individual recorded by the issuing organisation. This, however, does not prevent the bond from being legally traded in the secondary market.

- Government Bonds: government bonds have a relatively low interest rate, but are generally regarded as being risk free. Bonds issued by local governments or municipalities are often made attractive to investors as they carry with them tax benefits.

- Special Issue Bonds: the special issue bonds are usually issued by governments in times of crisis in order to fund projects that cannot be adequately financed through fiscal planning. The US issued War Bonds to finance their involvement in the World War, and more recently, owing to the financial crisis of 2008, issued “Build America” bonds to mitigate the effects of the deepening recession. Also worth note are the Climate Bonds aimed at financing sustainable forms of energy production.

- Foreign Currency Bonds: issuers of bonds might look for foreign investment and therefore offer coupon payments in a foreign currency. Investors might seek foreign currency bonds if they believe their local currency will weaken.